5 stealth taxes that could deplete your wealth this year, and how we can help

Despite recent cuts to National Insurance rates, there is still a chance you could end up paying more tax on your income and assets over the coming years due to something called “fiscal drag”.

Fiscal drag occurs when tax thresholds remain frozen rather than rising with inflation.

Over the past few years, the government has announced a freeze on a number of tax thresholds. In some cases, tax thresholds have even been lowered.

So, even though frozen or lowered thresholds may not affect you immediately, as wages and asset values rise, they could have an impact on your personal tax position. That’s why we call it “fiscal drag” – rather than your personal finance circumstances changing directly, stealth taxation “drags” a greater portion of your wealth into the taxable bracket.

Read on to learn more about five stealth taxes that could make you vulnerable to fiscal drag, and discover how your financial adviser can help you to mitigate your tax bill.

5 stealth taxes that could affect your wealth in the coming years

Below are five tax thresholds that have been frozen or reduced, which could lead to you paying more tax overall in 2024/25 and beyond.

1. The Personal Allowance and higher-rate Income Tax band thresholds have been frozen

The Personal Allowance and higher-rate Income Tax bands have both been frozen until April 2028. This means that, as wages rise, more people will need to pay tax on a larger portion of their income.

The Office for Budget Responsibility (OBR) estimates that, in the period between 2022/23 and 2027/28, nearly 4 million additional individuals will be expected to pay Income Tax and 3 million more will have moved to the higher rate as a result of the freeze.

2. The additional-rate Income Tax threshold has fallen

On 6 April 2023, the government reduced the threshold for additional-rate (45%) Income Tax from £150,000 to £125,140.

The change has meant that, from 2023/24, more people will have been pulled into the additional-rate tax band. Those who were already within this band will now pay additional-rate tax on a larger proportion of their income.

According to the OBR, the change has led to around 400,000 more individuals needing to pay the additional rate of Income Tax between 2023/24 and 2027/28.

3. The government has reduced the Dividend Allowance

You may need to pay tax on income you receive from dividends if it exceeds the Dividend Allowance (and any unused Personal Allowance).

This includes dividends from investments that aren’t held in a tax-efficient wrapper such as an ISA, or from a company you own or have shares in.

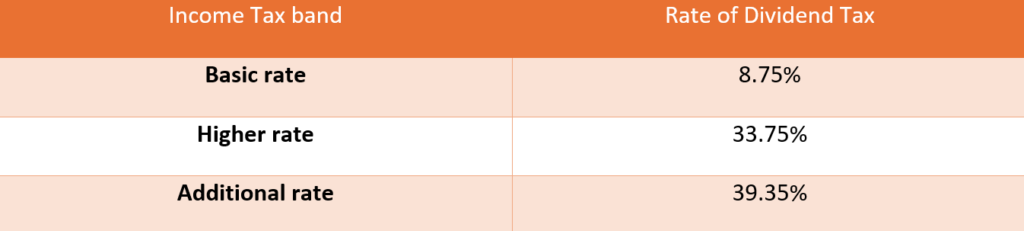

In 2024/25, the Dividend Allowance has been halved from £1,000 to £500, after falling from £2,000 in the previous year. The rate of Dividend Tax that you pay depends on your Income Tax band, as shown below.

This reduction means that you could now be paying Dividend Tax for the first time, or pay more of it this year than you had in previous years.

4. The Capital Gains Tax Annual Exempt Amount has fallen

The amount of profit you can make from selling taxable possessions has also fallen. Capital Gains Tax (CGT) may be payable on the profits you make from selling items such as:

- Business assets

- Property that isn’t your main home

- Stocks and shares that aren’t held in a tax-efficient wrapper

- Personal possessions worth more than £6,000, excluding your car.

The government has reduced the amount of profit you can make before CGT may be payable, known as the “Annual Exempt Amount”.

In 2024/25, the CGT Annual Exempt Amount has fallen from £6,000 to just £3,000, having been reduced from £12,300 in 2022/23. If your profits exceed £3,000, the rate of CGT that may be payable depends on a few factors.

- If you are a basic-rate taxpayer and your profits fall within the basic-rate band when added on top of your income, a rate of 10% applies to most taxable assets, rising to 18% for residential property.

- Higher- and additional-rate taxpayers usually pay CGT at a rate of 20%, or 24% for residential property, as do basic-rate income taxpayers where the taxable gain crosses over into a higher tax band.

So, it may be helpful to consider how to mitigate a CGT bill before selling your assets.

4. The nil-rate band for Inheritance Tax has been frozen until April 2028

If your estate is worth more than the nil-rate band when you pass away, your family may need to pay Inheritance Tax (IHT) on your estate. In 2024/25, the nil-rate band is £325,000.

The residence nil-rate band may also apply if you are passing on your home to a direct descendent. The residence nil-rate band is £175,000.

The nil-rate band and residence nil-rate band have both been frozen until April 2028.

So, as property and other assets rise in value over time, more families are likely to find that their estate is liable for IHT – and if your family was already likely to pay this tax, they could now need to pay a higher bill.

Your financial adviser can help you plan around stealth taxes

Fortunately, there are steps you can take to mitigate the impact that these stealth taxes could have on your wealth.

Your financial adviser can help you to understand the tax rules, allowances, and reliefs that apply to you so that you can make the most of your income and minimise your tax bill. This might include the following.

Identify tax-efficient wrappers to hold your savings and investments

A simple way to mitigate your tax bill is to hold your savings and investments in a tax-efficient wrapper such as an ISA. This may be particularly helpful given the reduction to the CGT Annual Exempt Amount and Dividend Allowance.

You can deposit up to £20,000 across your adult ISAs (some exceptions apply) in 2024/25.

Use pension contributions to reduce your taxable income

Provided your own contributions don’t exceed 100% of your earnings (or £3,600 if more), your pension contributions are eligible for tax relief at your marginal rate. So, this could be a helpful way to save for your retirement while also mitigating your tax bill for the year.

If all pension contributions combined, your own and your employer’s if applicable, exceed the Annual Allowance, tax is payable on the excess.

The Annual Allowance in 2024/25 is £60,000. You may have a smaller Annual Allowance if you are a high earner or have already flexibly accessed your pension. You may have more Annual Allowance to use if you haven’t fully used your Annual Allowances in the previous three tax years (but did have a pension in place in those years).

Planning your finances as a couple could improve tax efficiency

Planning your finances as a couple can help to improve your tax efficiency because each tax-efficient allowance or threshold applies to individuals. So, as a couple, you could essentially double your tax breaks.

By being strategic about how you manage your finances together, you could make the most of these allowances to mitigate your bill.

Use gifting allowances to reduce the value of your estate

If your estate may be liable for IHT after you pass away, giving financial gifts to your loved ones could help you to reduce its value and minimise this bill for your family.

There are several allowances that mean your gift is normally immediately removed from your estate for IHT purposes, including:

- The £3,000 annual exemption

- The small gift allowance, enabling you to give unlimited gifts of up to £250 per recipient to any number of people (this exemption can’t be used if the recipient has received more than £250 from you in the tax year)

- Gifts for weddings and civil partnerships, under which you can gift your child up to £5,000 for their wedding or civil partnership, falling to £2,500 for grandchildren, and £1,000 for anyone else.

- Regular gifts out of surplus income.

Gifts that exceed these allowances may still be liable for IHT if you pass away within seven years.

Get in touch

If you’d like to learn more about how we can help you to reduce the effects of fiscal drag on your wealth, please get in touch.

Email info@chancellorfinancial.co.uk, or call 01204 526 846 to speak to an adviser.

If you’re already a client here at Chancellor, contact your personal financial adviser to discuss any of the content you’ve read in this article.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change. The information contained within this article is based on our understanding of legislation, whether proposed or in force, and market practice at the time of writing. Levels, bases and reliefs from taxation may be subject to change.

The Financial Conduct Authority does not regulate estate planning or tax planning.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Remember that taper relief only applies to gifts in excess of the nil-rate band. It follows that, if no tax is payable on the transfer because it does not exceed the nil-rate band (after cumulation), there can be no relief.

Taper relief does not reduce the value transferred; it reduces the tax payable as a consequence of that transfer.